The stock market is the heartbeat of the American economy. Whether you’re a seasoned investor or just dipping your toes into the world of stocks, understanding how it works and how you can benefit is crucial. In this guide, we’ll break down everything you need to know, from the basics of investing to insider tips that can help you make smarter financial decisions.

Why Investing in the Stock Market is a Game Changer

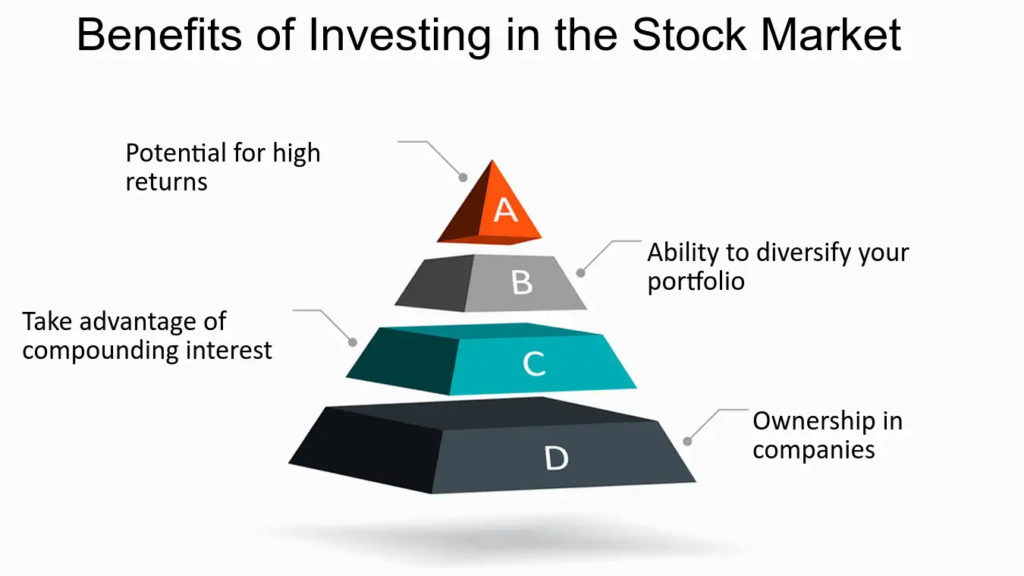

If you want to grow your wealth, investing in the stock market is one of the most powerful ways to do it. Unlike traditional savings accounts, the stock market offers the potential for higher returns over time. Here’s why you should seriously consider investing:

- Wealth Building: Investing in stocks allows your money to work for you and compound over the years.

- Beating Inflation: Stocks historically provide returns that outpace inflation.

- Passive Income: Dividend-paying stocks provide a steady stream of income without active involvement.

- Ownership in Companies: When you invest, you own a piece of businesses you believe in.

- Tax Advantages: Certain accounts, such as IRAs and 401(k)s, offer tax benefits that can maximize your savings.

Stock Market Basics: Understanding the Key Players

To navigate the stock market successfully, you need to understand the major players and how everything fits together:

- Stock Exchanges: In the U.S., the two biggest exchanges are the New York Stock Exchange (NYSE) and the Nasdaq. The NYSE lists many blue-chip companies, while the Nasdaq is home to tech giants.

- Investors: These can range from individual retail investors to large institutional investors like hedge funds, mutual funds, and pension funds.

- Brokers: Middlemen who facilitate buying and selling stocks. They can be traditional financial advisors or online platforms such as E-Trade and Charles Schwab.

- Market Makers: Entities that ensure liquidity in the market by buying and selling stocks continuously.

- Regulators: Government agencies like the SEC (Securities and Exchange Commission) ensure fair trading practices and protect investors.

How to Start Investing in Stocks

Starting your investing journey doesn’t have to be complicated. Here’s a step-by-step guide to get you started:

- Set Clear Goals: Are you investing for retirement, passive income, or wealth accumulation? Defining your goals will shape your investment choices.

- Choose a Brokerage Account: Popular platforms include Robinhood, Fidelity, and TD Ameritrade, each offering different features tailored to investors.

- Understand Risk Tolerance: Assess how much risk you’re willing to take based on your financial situation and long-term goals.

- Diversify Your Portfolio: Don’t put all your eggs in one basket; spread investments across different sectors and asset classes.

- Start Small and Scale Up: Begin with a manageable amount and gradually increase investments as you gain confidence.

- Stay Educated: Read financial news, attend webinars, and follow expert opinions to stay updated on market trends.

Popular Investment Strategies That Work

Different investors have different approaches to the market. Some of the most effective strategies include:

- Buy and Hold: Investing in strong companies and holding for the long term to benefit from price appreciation and dividends.

- Dividend Investing: Focus on stocks that provide regular payouts, offering a source of passive income.

- Growth Investing: Targeting companies expected to grow rapidly, often in the technology or healthcare sectors.

- Value Investing: Buying undervalued stocks based on fundamental analysis and waiting for them to rise.

- Index Investing: Investing in index funds such as the S&P 500 to gain exposure to a diversified basket of stocks.

- Day Trading: Buying and selling stocks within the same day to capitalize on small price movements, requiring skill and experience.

Top Stocks to Watch Right Now

If you’re looking for inspiration, these stocks have been consistently strong performers:

- Apple (AAPL): A tech giant with a strong product ecosystem and global market presence.

- Amazon (AMZN): E-commerce dominance and cloud computing growth make it a powerhouse.

- Tesla (TSLA): Leading innovation in the electric vehicle market and sustainable energy solutions.

- Microsoft (MSFT): A leader in software, cloud services, and artificial intelligence.

- Nvidia (NVDA): Dominating the AI and graphics processing unit (GPU) industry.

- Johnson & Johnson (JNJ): A reliable choice in the healthcare sector.

- Alphabet (GOOGL): The parent company of Google, driving growth through advertising and technology.

Stock Market Mistakes to Avoid

Even the best investors make mistakes, but you can learn from their experiences and avoid these common pitfalls:

- Investing Without Research: Always analyze a stock before buying; don’t rely on hype or speculation.

- Emotional Trading: Avoid making impulsive decisions based on short-term market fluctuations.

- Ignoring Diversification: Spreading risk across various sectors is crucial for portfolio stability.

- Trying to Time the Market: Predicting short-term movements is nearly impossible and can lead to significant losses.

- Overlooking Fees: Brokerage and trading fees can eat into profits if not managed properly.

- Ignoring Market Trends: Keeping up with economic indicators and sector shifts is crucial.

The Role of Market Trends and Economic Indicators

Staying informed about market trends and economic factors can give you an edge. Pay attention to:

- Federal Reserve Policies: Interest rate decisions can influence borrowing costs and stock valuations.

- Employment Data: Strong job reports often correlate with market growth.

- Corporate Earnings Reports: Company performance updates impact stock prices significantly.

- Inflation Rates: High inflation can erode purchasing power and impact company earnings.

- Political and Global Events: Trade policies, wars, and pandemics can create market volatility.

How to Stay Ahead in the Stock Market

Success in the stock market requires continuous learning and adaptation. Here are some tips to stay ahead:

- Stay Educated: Follow financial news, read annual reports, and track economic indicators.

- Set Realistic Expectations: Understand that the market fluctuates, and downturns are normal.

- Rebalance Your Portfolio: Periodically adjust your holdings to align with your goals and risk tolerance.

- Follow Market Leaders: Learn from successful investors like Warren Buffett and Peter Lynch.

- Join Investment Communities: Engage in discussions with like-minded individuals and financial experts.

The Future of the Stock Market: What to Expect

The stock market is constantly evolving, and staying informed about future trends can help you stay ahead of the curve. Look out for:

- Technological Innovations: AI, blockchain, and fintech are reshaping the investing landscape.

- Sustainable Investing: More investors are focusing on ESG (Environmental, Social, Governance) criteria.

- Globalization Effects: International markets can influence U.S. stock performance and present new opportunities.

- Digital Assets: The rise of cryptocurrencies and blockchain-based securities is revolutionizing investing.

Conclusion: Your Path to Financial Freedom

Investing in the stock market is a journey that requires patience, knowledge, and strategic planning. Whether you’re investing for retirement, financial independence, or just to grow your wealth, understanding the market can empower you to make smart choices.

The key is to start now, stay informed, and make educated decisions based on sound financial principles. With the right mindset and a commitment to learning, the stock market can be a powerful tool to achieve your financial goals.